Apprentices are employees

On the 1st of April 2024, we move into the new national minimum wage (NMW) year; this is very important for all employers and apprentices to know as this is not guidance but law and must be adhered to across all industries.

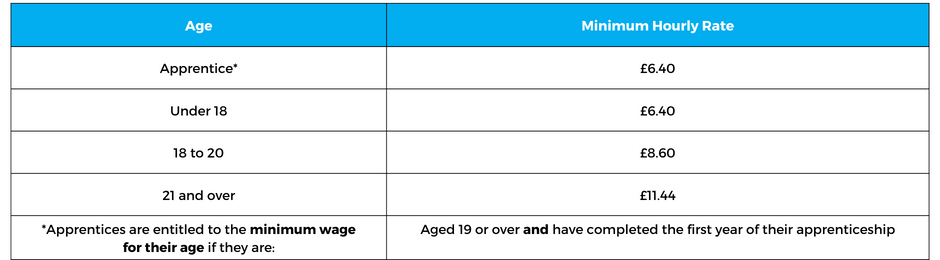

The NMW includes an apprentice category. The apprentice wage covers all apprentices under the age of 19 AND any apprentice regardless of age, in the first year of their apprenticeship. When an apprentice aged 19 or over has completed their first year, they are then entitled to the minimum hourly rate of the National Minimum Wage (NMW) for their age.*

The National Minimum Wage and Living Wage rates are as follows: April 2024 – March 2025

The UK government specifies what the NMW should be and it is the employer’s responsibility to ensure that they are paying at least this. For further information please read the full details on the government website.

Our apprentices are also encouraged to make sure that they do not accept less than the minimum wage and the government provide a handy calculator to help calculate this. National Minimum Wage and Living Wage Calculator.

* This is in England. In Wales apprentices are entitled to NMW regardless of their age, after the first year of their apprenticeship.

- If you offer accomodation do you still have to pay NMW?

Yes, but as an employer, they are entitled to deduct a set daily/weekly amount from the National Minimum Wage and National Living Wage rates to cover this.

Rates that can be charged for accommodation are laid out on the government website.

- Does an apprentice get a contract of employment?

Signed contracts must be in place at the start of any apprenticeship. These confirm the individual employment arrangements between an employer and an apprentice, including pay and hours. An apprenticeship agreement must also be in place outlining the apprenticeship and its duration. Both the employer and apprentice must sign these agreements.

For an agreement template please follow the link to the government website GOV.UK.

Equine employers may also benefit from Equestrian Employers Association (EEA) membership who provide tools and resources, such as a contract creator.

- What is classed as working time?

Apprentices under the age of eighteen, cannot work more than forty hours per week and must have two consecutive days off. Apprentices aged eighteen or over cannot work more than forty-eight hours per week and must have one day off per week or two days off per fortnight.

Here are some examples of areas that should be included in working time.

Travelling time. Travelling in connection with a worker’s job is working time. This includes travelling to customers/competitions or training, but not between home and a permanent place of work.

Training time. Time spent on training counts as working time.

Additional time. This can often occur either end of an employee’s shift when they may have to arrive early or stay late, for example, an employee might have to arrive 20 minutes early before their shift starts to get to a competition or customer, or they may have to stay behind an additional 20 minutes to wait for a delivery or a farrier to finish; this must be counted as work time.

Working hours includes any time when the worker is at the employer’s disposal and is expected to carry out activities or duties for the employer.

- What should an employer do if they are paying the wrong rate?

Put it right – they must identify any arrears they owe to their workers, pay those arrears back to the workers and pay the correct rates going forward.

If they fail to act they can be reported to the HMRC where they will then be considered for investigation, which can result in penalties of up to £20,000 per underpaid worker. The information may also be made public, which could have a significant impact on the reputation of their business.

- Useful Links

ACAS – gives free, impartial advice on workplace rights, rules and best practice for employers and employees.

Equestrian Employers Association is the professional association for anyone who employs staff or manages yards and we’re pleased to offer all of our employers an exclusive discount on their membership.

British Groom Association we work very closely and are pleased to offer an exclusive membership discount to our learners (new members only)*.

News

Turning a Dream into a Career: Meet Level 2 Animal Care Apprentice Jade

We caught up with Level 2 Animal Care Apprentice, Jade, on her apprenticeship experience and her hopes for the future! MORE

Apprenticeship Ambassador Emilia: Blog 13

Emilia updates us on her recent competitions, events, and her current apprenticeship. MORE

Join us for our Racing Apprenticeship Taster Day

Sign up for our upcoming Racing Apprenticeship Taster Day taking place on 2nd April 2024! MORE

Alternative Education: Cotswold RDA

Read all about our exciting partnership with Cotswold RDA (Riding for the Disabled Association). MORE